From April 2027, a little-known technical change will come into...

Read MoreArticles

Agriculture and Business Property Relief

In practical terms, the higher cap could allow a couple...

Read MoreUmbrella Companies Under Fire

The message was clear: HMRC would pursue not only the...

Read MoreHMRC Digital by Default

Did you know that, from March 2026, HMRC will stop...

Read MoreBudget 2025 Review

At first glance, the Autumn Budget 2025 seemed relatively uneventful...

Read MoreAutumn Budget 2025

Chancellor of the Exchequer Rachel Reeves set out tax-raising measures...

Read MoreGifting and Wills

Major tax changes are coming that could significantly reduce what...

Read MoreWhat Could the Autumn Budget Mean for LLPs

The 26 November Autumn Budget could introduce one of the...

Read MoreWealth Tax vs IHT and CGT

As the UK weighs the idea of a wealth tax...

Read MoreUnder the microscope

HMRC is stepping up its efforts, aiming for a 20%...

Read MoreExecutor Liability for IHT

Are you aware how upcoming pension tax reforms could leave...

Read MoreSpotlight 63 Revisited

HMRC's current penalty framework has become a source of mounting...

Read MoreHMRC Penalties and the Small Business Tax Crisis

HMRC's current penalty framework has become a source of mounting...

Read MoreHMRC Debt Is Reshaping Business Behaviour

UK businesses now owe HMRC around £28 billion a month,...

Read MoreHMRC in Crisis

HMRC in Crisis: Service Failures and the Tax Reform Debate.

Read MoreHMRC Letters to Logins

Letters to Logins: Are You Ready for HMRC’s New Way...

Read MoreThe Non-Dom Exodus

The Non-Dom Exodus: Why the Stakes Are Higher Than Ever...

Read MoreThe Bryan Robson IR35 Tribunal

The Bryan Robson IR35 Tribunal: Key Implications for Contractors and...

Read MoreWhy IR35 Is Britain’s Hidden Growth Tax

How did a policy designed for fairness end up holding...

Read MoreHMRC Crypto Tracking

The days when crypto investors operated under the radar are...

Read MoreList of Articles

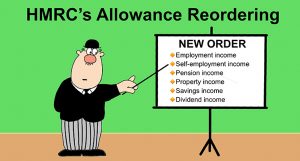

HMRC’s Allowance Reordering

From April 2027, a little-known technical change will come into force, one that could quietly cost you thousands in extra...

Agriculture and Business Property Relief

In practical terms, the higher cap could allow a couple to protect up to £5 million of qualifying agricultural or...

Umbrella Companies Under Fire

The message was clear: HMRC would pursue not only the promoters of tax avoidance schemes, but also those who enabled...

HMRC Digital by Default

Did you know that, from March 2026, HMRC will stop sending letters by post as standard and switch to digital...

Budget 2025 Review

At first glance, the Autumn Budget 2025 seemed relatively uneventful - no major tax hikes and no shock policy reversals.

Autumn Budget 2025

Chancellor of the Exchequer Rachel Reeves set out tax-raising measures worth up to £26 billion in the Autumn Budget on...

Gifting and Wills

Major tax changes are coming that could significantly reduce what your family inherits, especially if you own a business, farm,...

What Could the Autumn Budget Mean for LLPs

The 26 November Autumn Budget could introduce one of the most significant tax shifts for professional services in recent memory.

Wealth Tax vs IHT and CGT

As the UK weighs the idea of a wealth tax (again!), this is not just theory, as other countries have...

Under the microscope

HMRC is stepping up its efforts, aiming for a 20% increase in serious fraud charges by 2030, supported by enhanced...

Executor Liability for IHT

Are you aware how upcoming pension tax reforms could leave personal representatives dangerously exposed?

Spotlight 63 Revisited

HMRC's current penalty framework has become a source of mounting concern. Designed to incentivise timely tax filing, the system has...