How HMRC’s Allowance Reordering and New Rates Will Cost You More from 2027

A subtle change in how your personal tax allowance is applied could have an impact on what you pay HMRC. For years, most taxpayers haven’t needed to worry about how HMRC divides up their personal allowance across different types of income. However, that changes from April 2027.

Not because the allowance itself is changing. But because the government is pairing a legal lock on how it’s applied with new, higher tax rates on savings, dividends, and property income. Individually, those changes are easy to overlook, but together, they form a quiet but powerful tax increase that will hit landlords, savers, and investors especially hard.

Let’s unpack what’s changing, why it matters now, and who needs to take action before the new rules arrive.

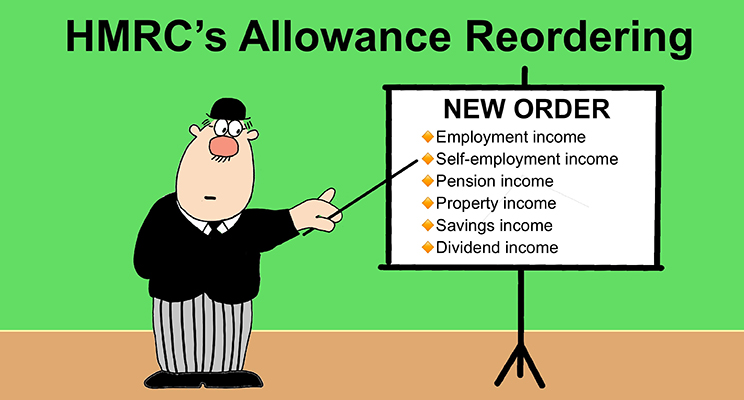

What’s Changing: A Fixed Order for the Personal Allowance

From the 2027/28 tax year, your personal allowance – currently £12,570 – will be required to apply first to income from employment, self-employment, and pensions. Only once that income has been accounted for will any remaining allowance be used on property income, savings interest, or dividends.

This is the official order:

- Employment income

- Self-employment income

- Pension income

- Property income (including rental)

- Savings income

- Dividend income

So far, so technical, but it ends a long-standing feature of the system: a degree of flexibility in how income streams interact with your allowance. Up until now, the order didn’t really matter unless you had very specific income mixes. That’s because income from work, rent, and savings was generally taxed at the same rate bands: 20%, 40%, and 45%.

From 2027, that parity disappears.

Why the Order Now Matters: New Higher Tax Rates

This section explains why a change in the order of applying allowances suddenly matters. The real sting lies not in the rule itself but in how it will now interact with higher tax rates.

The government is introducing separate, higher tax rates for property and savings income from April 2027:

- Property and savings basic rate: 22%

- Property and savings higher rate: 42%

- Property and savings additional rate: 47%

Dividend income, already taxed differently, also rises from April 2026:

- Dividend ordinary rate: 10.75%

- Dividend upper rate: 35.75%

- Dividend additional rate: 39.35%

So, when your personal allowance is locked to cover employment or pension income first, income taxed at the ‘normal’ 20%/40%/45% rates will push more of your rental or investment income into these harsher tax bands.

It’s not the ordering rule that does the damage. It’s the combination of fixed ordering and higher rates that turns this into a stealth tax hike.

Real-World Examples: How the Rule Change Affects You

To see how this plays out in real life, here are some worked examples relating to the order of taxation and a simple increase in non-employment-related rates. The numbers aren’t theoretical; these are common income mixes among clients we advise.

Example 1: Part-Time Worker with Rental Income

This is a typical scenario for semi-retired individuals or secondary earners who supplement their wages with a buy-to-let property.

- £6,000 salary

- £20,000 rental income

- £12,570 personal allowance

Tax Year 2026/2027:

- £6,000 of salary covered by allowance

- The remaining £6,570 personal allowance shields part of the rental income

- The annual rental allowance of £1,000 removes more income from the tax calculation

- Leaving £12,430 taxed at 20% = £2,486

From Tax Year 2027/2028:

- The same order and allowances apply, but rental income is now taxed at 22%

- Taxable rental income figure adjusted in line with 2025/26 allowance.

- £12,430 taxed at 22% = £2,735

Difference:

- Before: £2,486

- After: £2,735

- Extra tax: £249 (+10%)

Example 2: Retired Investor

This example covers many pensioners living on modest pensions, as well as income from property and investments built up over time.

- £24,000 pension

- £30,000 rental income

- £30,000 dividends

Tax Year 2025/2026:

- £12,570 of pension income will use the personal allowance

- Leaving £11,430 of pension income taxed at 20%

- The annual rental allowance of £1,000 and dividend allowance of £500 remove more income from the tax calculation

- Leaving £29,000 of rental income taxed at 20% and 40%

- And £29,500 dividend income taxed at 33.75% (before the April 2026 increase)

- Tax = £18,588

From Tax Year 2027/2028:

- £12,570 of pension income covered by allowance, £11,430 charged at 20%

- £26,269 of rental income charged at 22%, balance of £2,731 charged at 42%

- Dividends taxed at 35.75%

- Taxable rental and dividend income figures adjusted in line with 2025/26 allowances.

- Tax = £19,758

Difference:

- Before: £18,588

- After: £19,758

- Extra tax: £1,170 (+6%)

These case studies make it clear that this isn’t a hypothetical change. It’s one that will appear directly on people’s tax bills.

Example 3: Company Director on Low Salary with Dividends

This is a classic small business setup, where directors take a minimal salary to reduce National Insurance and top up income through dividends. While not affected by the reordering, it is worth noting the impact of the increased dividend tax rates.

- £9,000 salary

- £50,000 dividends

Tax Year 2025/2026:

- £9,000 salary + £3,570 of dividends covered by allowance

- £500 dividend income annual allowance

- Remaining £45,930 dividends taxed: partly at 8.75%, partly at 33.75%

- Approximate tax: £6,076

From Tax Year 2027/2028:

- £9,000 salary + £3,570 of dividends covered by allowance

- Remaining £45,930 dividends taxed at 10.75% and 35.75%

- Taxable dividend income figure adjusted in line with 2025/26 allowance.

- Approximate tax: £6,995

Difference:

- Before: £6,076

- After: £6,995

- Extra tax: £919 (+15%)

Who’s Most at Risk

This isn’t a blanket rise. It will hit some taxpayers harder than others, depending on how their income is structured.

- Landlords with modest employment income but substantial rental profits

- Small company owners who rely on dividends for income

- Retirees with a mix of pension and investment income

- Spouses or civil partners who previously benefited from income splitting strategies

These groups often used allowances efficiently across income types, but the new rules make this more challenging.

What You Can Do Now

You don’t need to wait until 2027 to prepare. Here are practical steps you can start discussing with your accountant.

- Revisit Your Income Structure

If you draw dividends from your company, rent property, or rely on savings, look at how your income will line up post-2027. Can you adjust drawdown strategies, ownership splits, or pension timing?

- Use ISAs More Aggressively

Income inside an ISA remains free of Income Tax. If you can shift investments into ISAs before 2027, you’ll sidestep the new higher rates completely.

- Spousal Transfers

If one partner has a low/negligible income, moving rental properties, savings accounts, or shareholdings to them could help them use their allowance more effectively.

- Professional Advice

This isn’t a DIY planning area – minor tweaks in timing or ownership could save thousands. A conversation with your accountant or tax adviser before 2027 is well worth the time.

These actions won’t apply to everyone, but for those affected, the savings can be meaningful.

Stay Vigilant: Tax is Always Moving

The allowance ordering change is a classic example of how tax shifts can creep in quietly but cost you heavily. While the headlines may focus on significant fiscal events, many of the most impactful rules are hidden in the details, making them easy to miss.

That’s why it’s essential to stay in regular contact with your adviser. Tax planning isn’t a one-off job; it’s a moving target. Delayed decisions or unclear communication could mean missing a deadline, misusing an allowance, or paying more than necessary.

HMRC doesn’t wait, and neither should you.

Final Thoughts

This is not a headline-grabbing tax rise. It’s more subtle than that, but no less costly.

By pairing a rigid ordering rule with increased rates on passive income, HMRC is quietly removing one of the few areas where taxpayers had planning flexibility. The losers are people who’ve worked hard to build rental income, investments, or retirement savings outside of pensions.

The sooner you map out how your income will interact with these new rules, the more control you’ll have over what you pay. Do nothing, and you may only discover the cost when your 2027/28 tax bill lands.

If you’re unsure how, or even if, these changes will impact your tax liabilities, why not contact us for an informal chat? Our team can help you reassess your position and navigate the evolving landscape with confidence.